Audit Opinions Cannot Be Classified as Which of the Following

The following is an example illustrating how the taxpayer does not always properly classify items that are listed in this report. Within this code are multiple records of vendors from whom the taxpayer claimed to have purchased items such as.

Auditor S Opinion Four Types Of Audit Opinion Definition And Explanation Wikiaccounting

Further this process of seeking ordinary representations from NSW.

. Financial Audit deals with determining whether an entitys financial statements and information is properly prepared complete in all respects and is presented with adequate. Audit Sampling 28 Audit sampling is the application of an audit procedure to less than 100 percent of the items within an account balance or class of transactions for the purpose of evaluating some characteristic of. During her tenure as United States Secretary of State Hillary Clinton drew controversy by using a private email server for official public communications rather than using official State Department email accounts maintained on federal servers.

The auditor is not required to consider audit findings or modifications of audit opinions based solely on Part 3L steps 10 and 11 when performing the risk based approach under OMB Circular A-133 if the auditor can determine that the recipient previously demonstrated a good faith effort to comply. They are issued to assist Service personnel in administering their programs by providing authoritative legal opinions on certain matters such as industry-wide issues. EAuditNet is web-based software that supports and improves efficiency in the auditing and accreditation systems of industry managed programs administered by the Performance Review Institute.

The Job Cost Report includes a code for Furniture and Fixtures. And the results of those audit procedures cannot be projected to the entire population. A careful analysis of the Job Cost Reports may yield significant audit adjustments.

Sections of the data which seemed to be distinct opinions of participants were highlighted to develop broad topics which were abbreviated into the predetermined code. In short the goal of the taxonomy is to accelerate green investments by providing transparency to. Substantive testing b.

See CCDM 3312 Chief Counsels Legal Advice Program. In fulfillment of audit mandate the following are the main types of audit that are conducted by Comptroller and Auditor General to meet the audit objectives. EAuditNet is developed and maintained by PRI for the benefit of industries where safety and quality are shared values implementing a standardized approach.

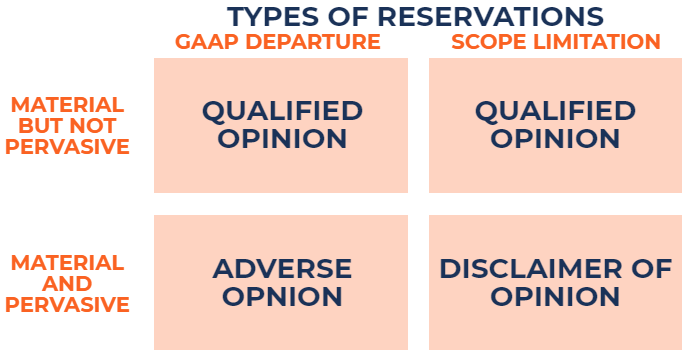

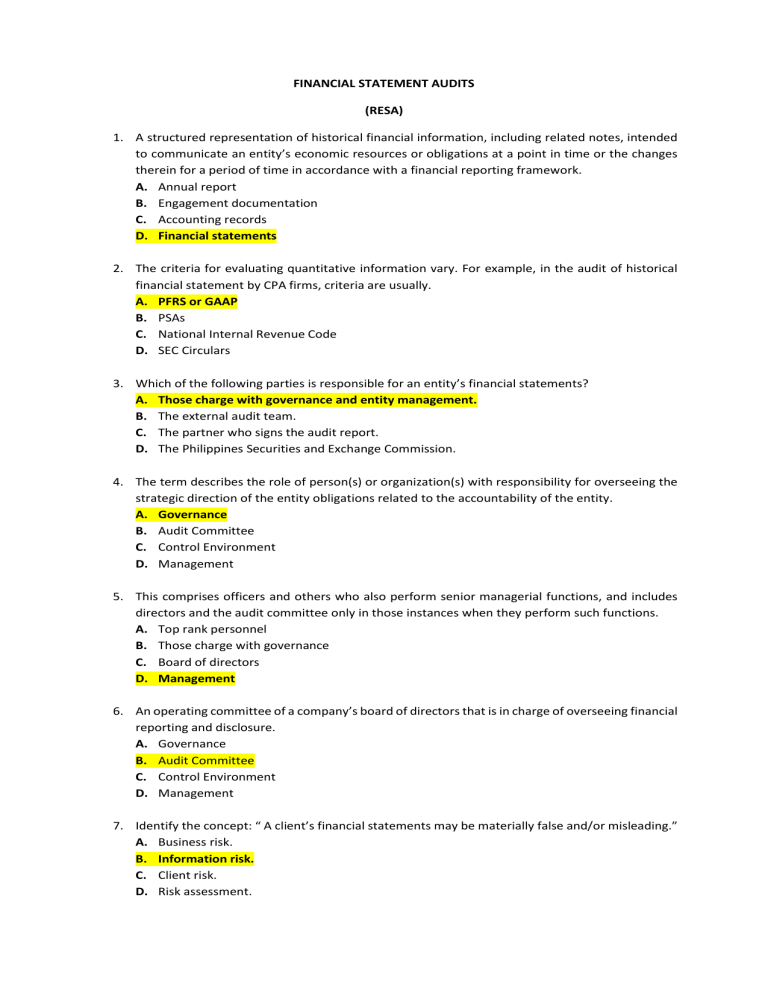

13 Audit procedures can be classified into the following categories. For example a material non-compliance material weakness in internal control over. When planning the audit information is gathered by all of the.

In addition even following repeated requests for key information our process for seeking representations from management during audit completion identified further reports just prior to signing the audit opinion relevant to the audit that had not yet been shared and should have been shared. Opinions issued to the Governor and the heads of the executive departments are classified as Official Opinions Those issued to other state officers such as legislators judges or district attorneys are classified as Unofficial Opinions Additionally from time to time the Attorney General will approve interstate compacts or issue position papers on questions of state law. The taxonomys goal is to solve this issue by providing clear rules on what can be classified as green or environmentally sustainable in order to mobilise financing for those economic activities that make a contribution to the EUs environmental objectives.

4 Has a tax exemption ruling from the Internal Revenue Service under section 501c3 or 4 of the Internal Revenue Code of 1986 26 CFR 1501c3-1 or 1501c4-1 is classified as a subordinate of a central organization non-profit under section 905 of the Internal Revenue Code of 1986 or if the private nonprofit organization is an wholly owned entity that is disregarded as an. All of the following are steps in an IT audit except a. Coded sections were read again to mark sections that fitted into the topic and grouped similar data from the quotes and classified them to develop themes subthemes and categories Creswell 2014.

Post-audit testing d. Clintons server was found to hold over 100 emails containing classified information including 65 emails deemed Secret and 22 deemed Top. An audit report is an independent opinion of a personfirm ie.

Auditor about whether the financial statements present a true fair view of the state of affairs of the entity profitloss of the entity cash flows for the year and such opinion is given after performing reasonable audit procedures so obtain sufficient appropriate evidence for the assurance. Auditors express an opinion in their audit report. Tests of controls c.

Auditors compare evidence to established criteria.

4 Types Of Audit Report Explanation Examples Accountinguide

Belum ada Komentar untuk "Audit Opinions Cannot Be Classified as Which of the Following"

Posting Komentar